We are the trusted Swiss partner for financial intermediaries

Our dedicated FIM Desk is offering privileged and exclusive investment services for your clients - be it Private Markets, Longevity Investments, Digital Assets and many more. Learn more how we can help you to be successful for your clients.

NOW IS THE TIME TO INVEST INTO THE LONGEVITY REVOLUTION

Kaleidos longevity investment

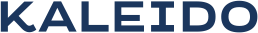

Our innovative investment solution provides holistic access to both public and private opportunities through a tailored and flexible Kaleido mandate. We are partnering with top-tier venture capital and private equity experts to provide access to the most interesting investment opportunities in this highly dynamic field.

Our scientific advisory board plays an integral role, providing valuable guidance on the most promising developments and areas of interest. On the liquid investment side, an in-house actively managed portfolio will offer exposure to longevity via listed companies, ensuring that you are at the forefront of developments in the public markets.

You choose a mix, we take care of the rest.

Investment Framework

As one of the fastest-growing markets, projected to reach trillions of dollars in the coming years, longevity offers a rich field of investment. The market's growth is driven by increasing consumer/patient demand and scientific breakthroughs.

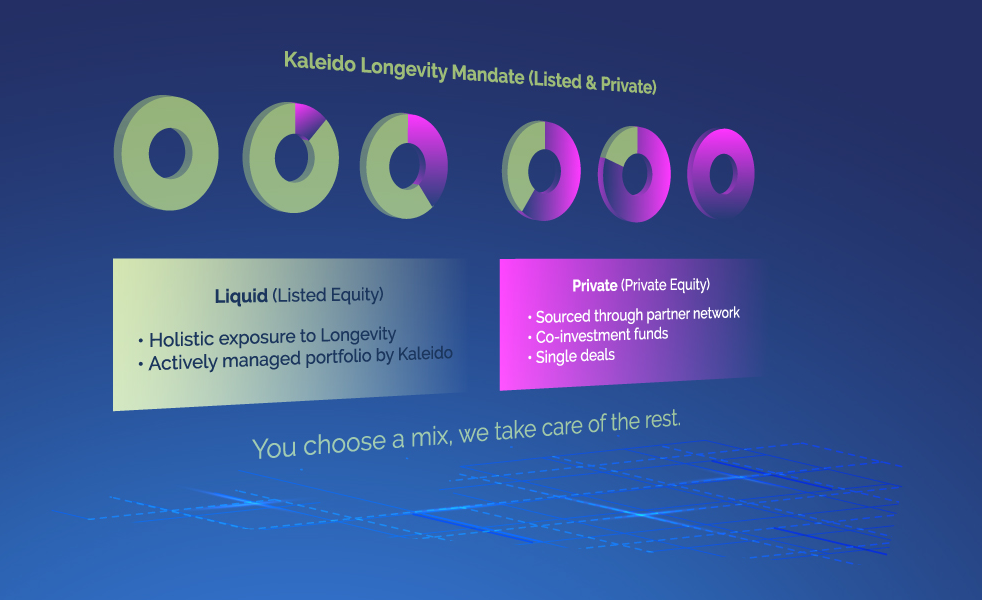

We have categorized areas of investments into three main areas of interest: Medical, Behavioral, and Societal. Fields and their composition will change over time with the area of Longevity evolving.

Holistic Exposure to Structural Drivers of Longevity

Dedicated personnel with relevant experience and access to the entire collective intelligence and capabilities to guarantee a best-in-class service

Christian Oertli

Head Financial Intermediaries

Drawing from 30 years of experience in the private banking industry, Christian leads the dedicated team for FIMs. He is the strategic partner for all relations with FIMs, ensuring their productive development.

Martin Petermann

Senior Advisor Financial Intermediaries

With 25 years in Private Banking and 15 years dedicated to Financial Intermediaries, he excels in managing complex global relationships and providing exceptional service.

Monty Stoller

Senior Advisor Financial Intermediaries

Monty, with 30 years of global banking experience, including 10 years in the FIM business, has a profound knowledge in the areas of client relationship, business, project and process management.

SOME MORE OFFERING HIGHLIGHTS

Private Placement Life Insurance Policies (PPLIs)

Gain access to top firms specializing in personalized life insurance policies for wealth structuring, tax planning, and succession planning.

Our services ensure compliance with the policy holder's tax domicile, offering efficient due diligence, high discretion, and rapid account opening.

Custody and Trading of Digital Assets

Custody, brokerage and credit services for more than 20 crypto currencies as one of very few private banks.

Convenient access via e-banking portal.

Digital assets desk with strong industry experience and network.

Payment Services from West to East

Deep understanding both of Eastern European and Central Asian markets where we have gained local expertise.

As one of very few Swiss private banks we facilitate transaction and trading activities between East and West.

Our custody services include the safekeeping and administration of securities and other financial assets on behalf of clients.

Safekeeping: We hold and safeguard the physical securities and other financial assets on behalf of clients. This includes keeping track of the ownership and movement of these assets, as well as ensuring that they are protected against loss or damage.

Asset servicing: We provide a range of services related to the administration and management of financial assets, including collecting dividends and other income, issuing and redeeming securities, and handling corporate actions such as mergers or stock splits.

Our trading services include the execution and settlement of securities transactions on behalf of clients.

We facilitate the settlement of trades and other transactions involving financial assets under our custody. This includes verifying the accuracy of the trade, transferring the assets from one party to another, and ensuring that all relevant parties receive the appropriate payment.

Our reporting services include both paper-based an electronic provision of securities reporting on behalf of clients.

We maintain accurate and up-to-date records of the financial assets under our custody, including the ownership, value, and any transactions related to these assets.

Our comprehensive credit, loan and lending facilities are also available to end-clients managed by our business partners.

Whether it's a complex structured finance, a single stock lending, or simply a mortgage, contact us to enable the relevant solution for you.