Select Focus

You select or let us select focus for you

Stable and long-term income according to your risk profile.

Variety of satellites reflecting our experts' market views and provide exciting and highly specialized strategies.

Please click on the blue "+" sign to open the full menu.

We have the right products for you, for a secure future.

We provide you with the right advice, to be future-proof.

It all starts with a friendly conversation. Just contact us.

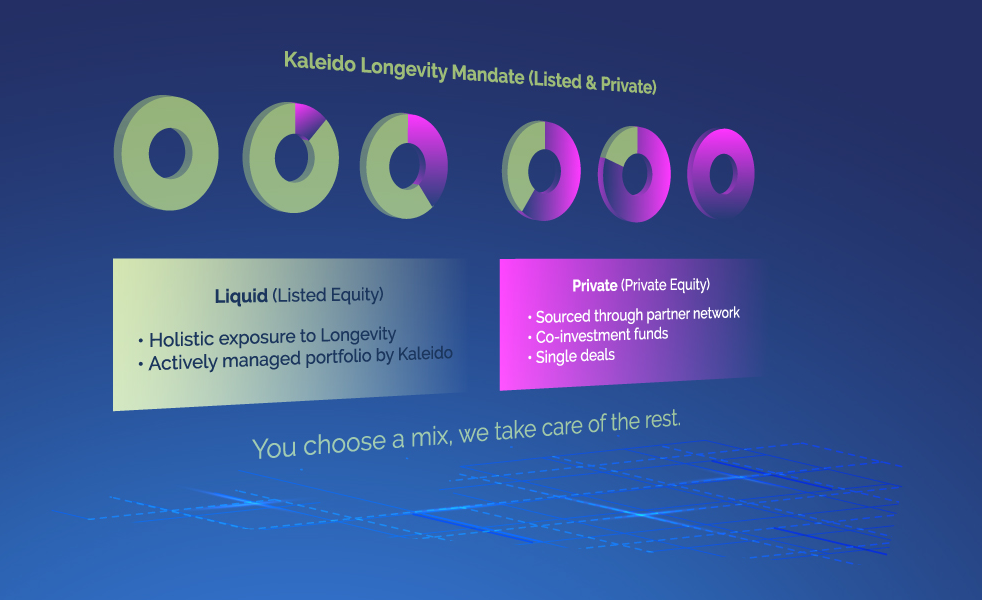

We are happy to make your investments reflect every piece of your values, beliefs and interests. Together with our experts you can define specialized investment vehicles to supplement your core portfolio. With this individualization and performance go hand in hand.

Our investment experts will choose satellites that optimize risk and return of your portfolio. We are constantly on the look-out for new satellites to design specific portfolio characteristics.