Select Focus

Please click on the green "+" sign to open the full menu.

Get in touch with the most progressive private bank in Switzerland.

We have the right products for you, for a secure future.

We provide you with the right advice, to be future-proof.

It all starts with a friendly conversation. Just contact us.

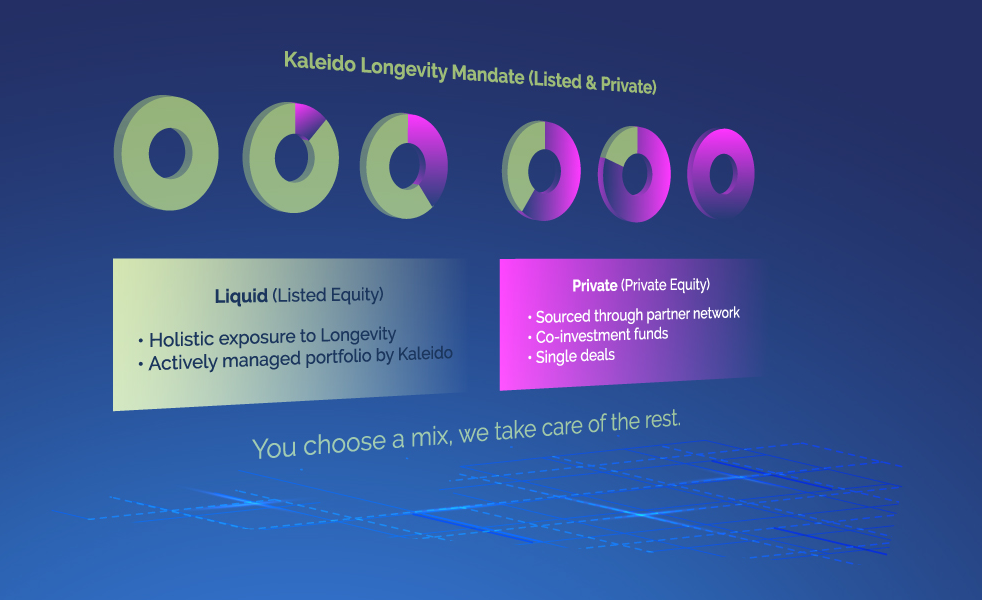

Our innovative investment solution provides holistic access to both public and private opportunities through a tailored and flexible Kaleido mandate. We are partnering with top-tier venture capital and private equity experts to provide access to the most interesting investment opportunities in this highly dynamic field.

Our scientific advisory board plays an integral role, providing valuable guidance on the most promising developments and areas of interest. On the liquid investment side, an in-house actively managed portfolio will offer exposure to longevity via listed companies, ensuring that you are at the forefront of developments in the public markets.

You choose a mix, we take care of the rest.

LEARN MORE ABOUT THIS EXCITING INVESTMENT OPPORTUNITY

The core portfolio is made up of a number of low-cost, diversified investments that provide broad exposure to a variety of asset classes. These core investments are designed to be relatively stable and consistent performers, and they are intended to provide a solid foundation for the overall portfolio.

The core of the portfolio is built and managed by our partner DCP, who we believe are the best in the industry to provide you with stable and long-term generating income opportunities according to your profile.

The satellite portfolio is made up of a number of actively managed investment strategies that are designed to provide more targeted, specialized exposure. The aim of the satellite portfolio is to provide additional resources of return by having exposure to specific investment strategies.

The satellites reflect our experts’ market views and provide exciting and highly specialized additions to your portfolio. Our first-class Investment Committee is constantly searching for new opportunities.

We are happy to make your investments reflect every piece of your values, beliefs and interests. Together with our experts you can define specialized investment vehicles to supplement your core portfolio. With this individualization and performance go hand in hand.

Our investment experts will choose satellites that optimize risk and return of your portfolio. We are constantly on the look-out for new satellites to design specific portfolio characteristics.

Our protect and grow strategy is designed to produce positive real returns over the cycle while protecting assets on the downside. We diversify your portfolio among different investment strategies as opposed to the traditional asset class diversification approach.

Our defensive liquidity strategy is, as the name implies, build to limit portfolio drawdowns. It offers an investment opportunity created to reduce volatility, has a high liquidity, and does benefit from strong markets.

By having meaningful conversations with our clients and listening to their needs and wants, we create our investment portfolios. Those solutions are also designed to offer large flexibility and ready to be tailored to our client’s interests -- for us, individualization and performance are mutually important. I would be delighted to give you more insights about our products in a personal meeting.